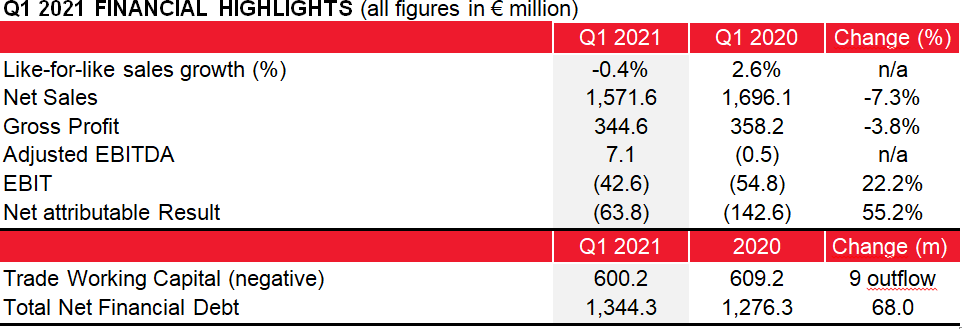

DIA narrowed losses by 55% year-on-year

Improved Gross Margin and Adjusted EBITDA driven by operational improvements.

2021 priorities focused on continued improvement of commercial offer, rollout of updated franchise model, light remodelling in stores, online expansion and operational improvements.

Group sales performance impacted by currency effects in Brazil and Argentina and fewer stores and, with full year-on-year comparison affected by Covid-19 stockpiling in March 2020.

Agreement with syndicated lenders, bondholders and reference shareholder establishes sustainable long-term capital structure.

MADRID, May 13th 2021: DIA Group, (“DIA” or “The Group”) the international food retailer that operates in Spain, Portugal, Brazil and Argentina, today issued its financial results for the first quarter 2021.

- Group Net Sales impacted by devaluation of Brazilian Real (26%) and Argentinean Peso (36%); resilient comparative local currency performances with Group Net Sales figure up 2.3% on a constant euro basis, and based on 6.2% fewer stores.

- Group Comparable Sales (Like-for-Like) were strong in January and February thanks to improved commercial and operational performance. March performance affected by comparison with period of exceptional Covid-19 pre-lockdown stockpiling in 2020.

- Gross Profit (as a percentage of Net Sales) increased to 21.9% from 21.1% year-on-year thanks to operational improvements implemented since late 2019.

- Adjusted EBITDA turned positive to 0.5% as a percentage of Net Sales.

- Net Result experienced an improvement representing less than half of the losses recognized during same period last year, driven by improved Adjusted EBITDA and effective foreign currency risk management.

- Available Liquidity of 293m (December 2020: 397m) with 80% in the form of Cash or Cash equivalents.

- Net Financial Debt (ex IFRS16): 1,344m up 68m versus December 2020 due to flat Cash Flow from Operations, controlled Capital Expenditures and stable Trade Working Capital.

Commenting on the results, Stephan DuCharme, Executive Chairman, said:

“Improved gross margin and adjusted EBITDA for the period demonstrate the continued positive impact of our commercial and operational enhancements already in place which are centered on building long-term relationships with all external stakeholders, especially our customers.

The extraordinary demand experienced by food retailers worldwide during lockdown months in 2020 will have an industry-wide impact on year-on-year comparative performance in 2021, we remain cautious about the trading environment going forward.

Thanks to the landmark agreement reached with syndicated lenders, bondholders and our reference shareholder, DIA is in a position to both substantially reduce leverage and accelerate its transformational business plan, ultimately improving our position as a modern proximity food retailer to create future value for all stakeholders.”