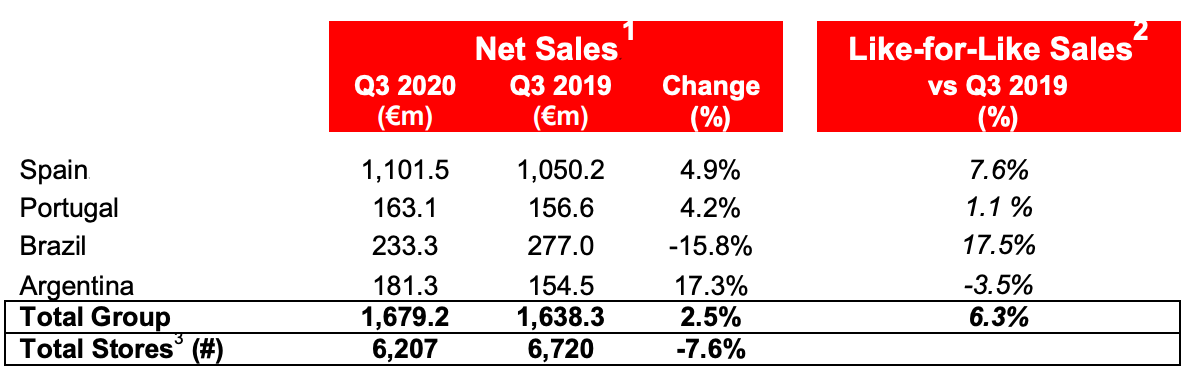

Q3 2020 Trading Update

Positive Group Net Sales and Like-for-Like growth maintained, driven by Spain and Brazil performance, with increased average basket size thanks to business transformation.

Spain and Portugal continue positive performance with benefits from enhanced fresh offer and updated franchise model.

Brazil and Argentina deliver strong local currency Net Sales performance on continued network and operations optimization.

MADRID, October 15 th, 2020: DIA Group (“DIA” or the “Group”), the international food retailer operating in Spain, Portugal, Brazil and Argentina, today issued a trading update for the third quarter of 2020.

Commenting on Q3 trading, Stephan DuCharme, Executive Chairman, said:

“DIA continued its positive trajectory in the third quarter and for the year to date, thanks to ongoing transformation efforts centred on delivering an enhanced fresh offer to customers.

Lower international tourism levels during the peak holiday season, which was visible in store traffic, did not have a material impact on our year to date performance in Spain and Portugal as we maintained higher average basket size and continued our push to become the go-to proximity offer.

We are encouraged by the positive sales performance in Latin America with both markets delivering strong net sales performance on a local currency basis. In particular, Brazil continues to benefit from improved supply chain and store operations as well as the roll out of a new commercial strategy. Argentina´s performance remains resilient despite the continued challenging macroeconomic environment.”

Spain:

Positive Net Sales trend continues strongly despite 8 per cent fewer stores year on year and negative seasonal effects.

Strong Like-for-Like growth in the quarter sustained by improved assortment and store lay-outs to support fresh offer.

New franchise model rolled out to over 700 stores as of September, which represents 65% of the franchises in Spain.

Portugal:

New operational model and optimized assortment supported positive Like-for-Like, more than offsetting the impact of lower tourism levels in main cities.

New franchise model implemented in over 145 stores representing approximately 60 per cent of franchised network.

Brazil:

Net Sales up 20 per cent in local currency despite 12 per cent fewer stores year on year following closure of underperforming locations. Euro performance impacted by the 30 per cent devaluation of the Brazilian Real during the period.

Strong Like-for-Like figures on the back of transformation measures including improved assortment offer and ongoing development of private label products.

Agreement reached with local partners to sell Rio Grande do Sul operations representing 79 stores (out of total) as part of strategic focus on sustainable growth and profitability in Sao Paulo state.

Argentina:

Net Sales up strongly on the back of improved operational performance in a challenging macroeconomic environment.

Like-for-Like volume impacted by low consumer confidence and consumption.

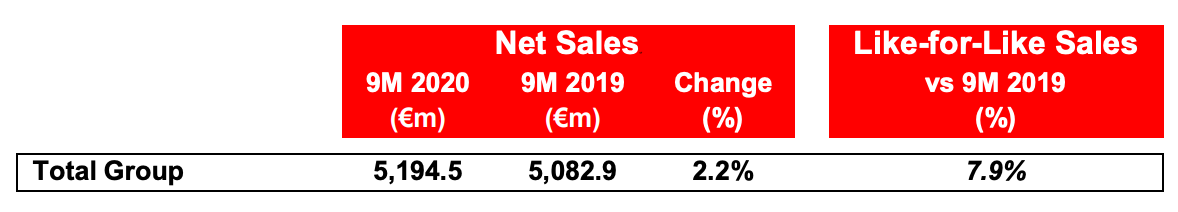

9M 2020 vs. 2019 Comparison: Sustained 8 per cent Like-for-Like Sales.