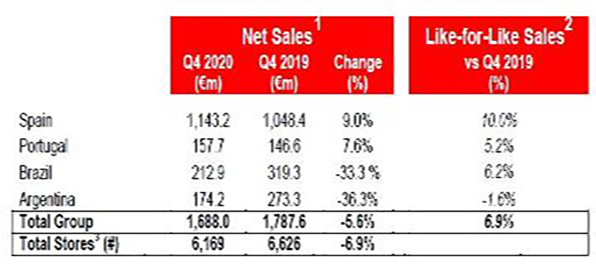

Trading update Q4 2020

Consistent positive Group Like-for-Like maintained, reflecting sustained improvement in commercial offer and operational performance.

More than 23 per cent increase in average basket size across all markets, more than offsetting 13 per cent fewer tickets.

Strong performance in Spain through continued emphasis on fresh assortment, positive customer take-up of new store lay-out and online expansion

MADRID, 14th January 2021: Dia Group (“DIA” or the “Group”), the international food retailer operating in Spain, Portugal, Brazil and Argentina, today issued a trading update for the fourth quarter of 2020.

Commenting on Q4 trading, Stephan DuCharme, Executive Chairman, said:

“DIA’s positive group Like-for-Like sales performance in the fourth quarter, continuing the trend seen throughout 2020, was thanks to the ongoing impact of sustained operational improvements and the enhanced fresh offer served to our customers at a time when they need us most.

Spain and Portugal maintained their positive net sales trajectory, while the strategic rationalisation of our store network with seven per cent fewer stores year on year as well as currency effects in Brazil and Argentina impacted our overall group net sales performance.

As we begin the new year, our relentless focus on finding and addressing areas of improvement across the operational chain will be enhanced by the continued roll out of our improved franchise model, the further development of our online capabilities, the expansion of our private label offer, as well as the initial launch of an exciting new store model.”

Spain:

- Positive Net Sales trend continues strongly despite 8 per cent fewer stores year on year.

- Strong Like-for-Like growth in the quarter supported by optimized assortment and new store lay-outs that underpinned excellent performance in fresh produce sales.

- Ongoing expansion of online and express delivery to meet new customer purchasing trends. Express delivery offer covering 90 per cent of population in cities over 50,000 inhabitants, through both owned and partnership channels.

Portugal:

- New operational model and optimized assortment supported positive Like-for-Like and Net Sales, despite government mandated shorter weekend opening hours during the last weeks of the year due to Covid-19.

- Online offering now covering main cities of Lisbon and Porto, with express delivery, mainly via partnerships, available from 100 stores spread across all regions where DIA is present.

Brazil:

- Net Sales down 6 per cent in local currency with 11 per cent fewer stores year on year following closure of underperforming locations and lower general consumption levels. Performance in Euros impacted by 29 per cent devaluation of the Brazilian Real during the period.

- Sound Like-for-Like thanks to improved assortment offer, ongoing development of private label products and express delivery implementation.

Argentina:

- Net Sales up 26 per cent in local currency on the back of improved operational performance, improved assortment and new store lay out to support fresh offer in a challenging macroeconomic environment. Euro performance impacted by the 31 per cent devaluation of the Argentinian Peso during the period.

- Like-for-Like volumes impacted by low consumer confidence and consumption but improving.

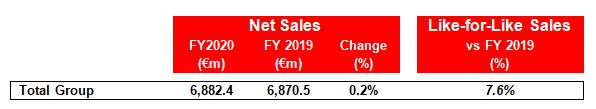

FY 2020 vs. 2019 Comparison: Sustained 8 per cent Like-for-Like Sales. Gross Sales Under Banner [4] grew 2.7% in constant currency year on year.

NOTES TO EDITORS

- The Dia Group will report its FY 2020 Financial Results on 26th February 2021.

[1] Net Sales expressed at current Euro exchange rate and under IAS29 for Argentina

[2] LFL represents growth rate of Gross Sales under Banner at constant currency of the stores that have been operating for more than thirteen months under the same conditions. LFL figures corresponding to Argentina have been deflated using internal inflation to reflect volume LFL, avoiding misleading nominal calculations in relation to hyperinflation

[3] At end of period

[4] Gross Sales Under Banner: Total Turnover Value obtained in stores, including indirect taxes (sales receipt value) in all the Company’s stores, both owned and franchise