Continued positive topline and Adjusted EBITDA performance supported by ongoing group

wide business transformation delivering over 25 per cent growth in average basket size

Improved financial position with ample liquidity, trade working capital inflows, positive cash flow

generation and reduced net debt.

Rollout of updated and mutually beneficial franchise model well advanced in Spain and Portugal.

DIA ready to serve our customers during Covid-19 second wave thanks to expansion of online and express delivery in all four countries – Spain express delivery now available to 90 per cent of population in major cities

MADRID, November 11th 2020: Dia Group, (“DIA” or “The Group”) an international food retailer that operates in Spain, Portugal, Brazil and Argentina, today issued its financial results for the third quarter and nine months 2020.

3Q20 FINANCIAL HIGHLIGHTS (all figures in €)

· Net Sales: 1,679m (3Q19: 1,638m), up 2.5% thanks to ongoing transformation efforts and despite smaller store network and significant currency effects.

· Like-for-Like: continued strong growth of 6.3% driven by 25.3% increase in average basket size, more than offsetting 15.1% decrease in number of tickets.

· Gross Profit: 366m (3Q19: 344m) up 0.8% as a percentage of Net Sales, supported by increased sales volumes and positive operational improvements.

· Labor Costs: 178m (3Q19: 175m) stable year-on-year as 2019 workforce rationalization measures continue to offset Covid-19 related staffing costs.

· Operating Expenses: up slightly to 0.8% as a percentage of Net Sales, driven by store defranchising process in preparation of the strategic roll out of new franchise model.

· Restructuring Costs and LTIP: 11m (3Q19: 7m) including some costs related to strategic sale of Rio Grande do Sul operations in Brazil.

· Adjusted EBITDA: 32m (3Q19: 16m), boosted by increased sales volume and improved gross margin supported by continued cost discipline.

· Net Profit: -58m (3Q19: -86m) primarily impacted by currency effects in Brazil.

· Available Liquidity: Ample levels at 439m (December 2019: 421m) with 94.4% in the form of Cash or Cash equivalents.

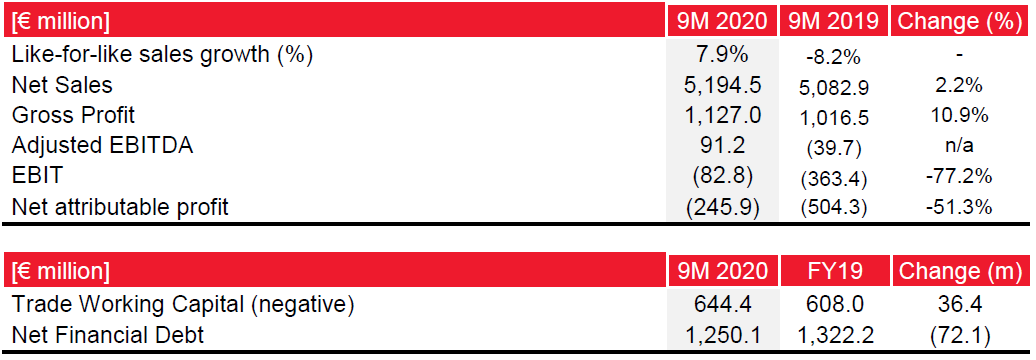

· Net Financial Debt: 1,250m down 72m versus December 2019 thanks to positive Cash Flow from Operations, controlled Capital Expenditures and improved Trade Working Capital.

9M20 FINANCIAL HIGHLIGHTS

9M 2020 TRANSFORMATION ROADMAP UPDATE

· Optimized assortment: Roll out to approximately 1,200 stores in Spain by year end with priority focus on fresh fruit and vegetable offer. Ongoing implementation in Portugal, supported by light refurbishment, and new assortment implemented in 65% of Argentinian stores.

· Private Label: Ready-made and new products now in store in Spain and Brazil as part of new offer combining quality, value-for-money and more attractive packaging.

· Online & Express Delivery: Ongoing expansion on online and express delivery in all four countries to meet new customer purchasing trends. Spain express delivery offer now covers 90% of population in cities over 50,000 inhabitants.

· Franchise: Improved incentive-driven franchise model rolled out to over 700 locations in Spain and 150 in Portugal ahead of launch of tailored offer in other markets.

· Operations: Continued focus on cost efficiencies and reduced complexity. Sale of underperforming operations in Brazil’s Rio Grande Do Sul Region driven by strategic focus on sustainable growth and profitability in the state of Sao Paulo – southeast Brazil.

Commenting on the results, Stephan DuCharme, Executive Chairman, said:

“DIA had a good quarter in terms of topline performance as our ongoing business transformation continues to deliver a real improvement in what customers see and experience in store with more fresh produce, better run stores and an attractive private label range. In addition to an evolving commercial value proposition, the quarter saw a positive inflection point in DIA`s relations with franchisees in Spain and Portugal based on the roll out of a new model that aligns DIA with its franchisees, stabilizes the outflow of franchisees and introduces an improved culture of engagement with these important partners.

We are closely monitoring the impact of new lockdown restrictions related to Covid-19, benefitting from lessons learnt during the first wave, and are ready to support the changing needs of our customers in terms of increased at-home consumption and demand for our expanded e-commerce and express delivery offer. In this sense, we are delivering on DIA´s purpose to be closer to our customers and communities, and are working harder, every day, to make this happen with the support of our neighborhood stores.”