Dia Group post net sales of €6.87BN for 2019, down 9.3%

February 27, 2020

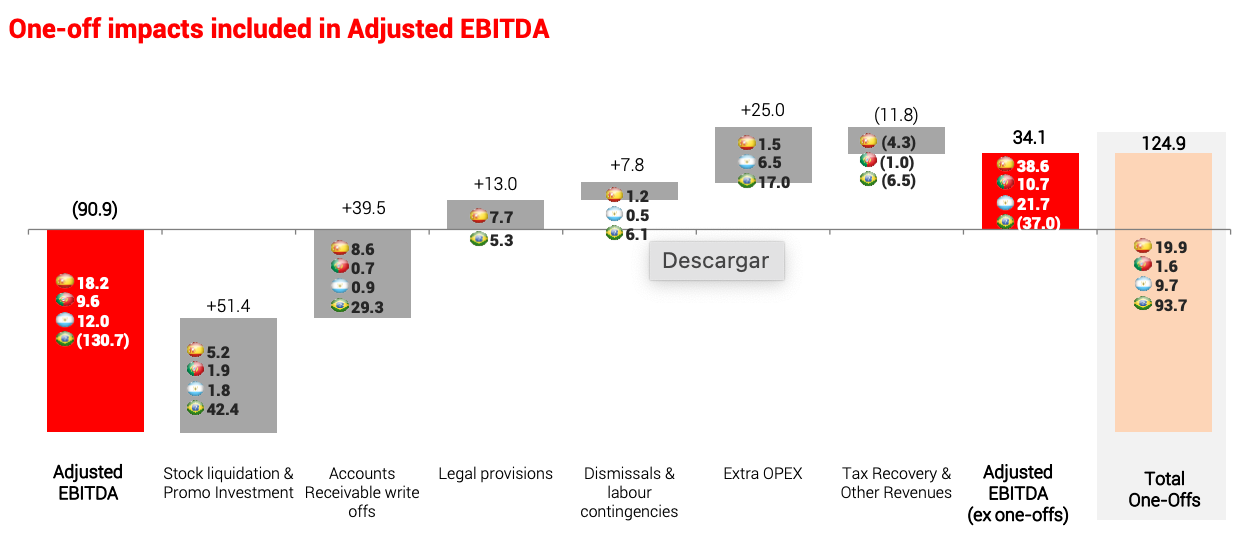

The Company achieved positive Adjusted EBITDA of EUR34,1m excluding one-offs.

The new leadership team has carried out crucial and significant groundwork to turn-around the business in all markets.

87 new management professionals have joined DIA across its 4 markets, providing additional proven retail expertise and capabilities locally.

“To fully recognize the Company’s situation is the first step to changing it. We have started 2020 with significant and crucial groundwork done. Going forward, we are determined to build our own success story which will be based on a modern proximity offer, an attractive value proposition, freshness, operational excellence, a win-win franchise model and an outstanding own brand offer.

DIA’s journey is today powered by very talented people with a unique local focus. We are fully committed to work on our transformation pillars to create the best customer experience.

Our efforts have encompassed not only improvement and optimisation across all critical areas but, equally important, extending best practices throughout the Group coupled with comprehensive financial controls. DIA’s transformation process gathers strength every day”, stated Karl-Heinz Holland CEO of Dia Group.

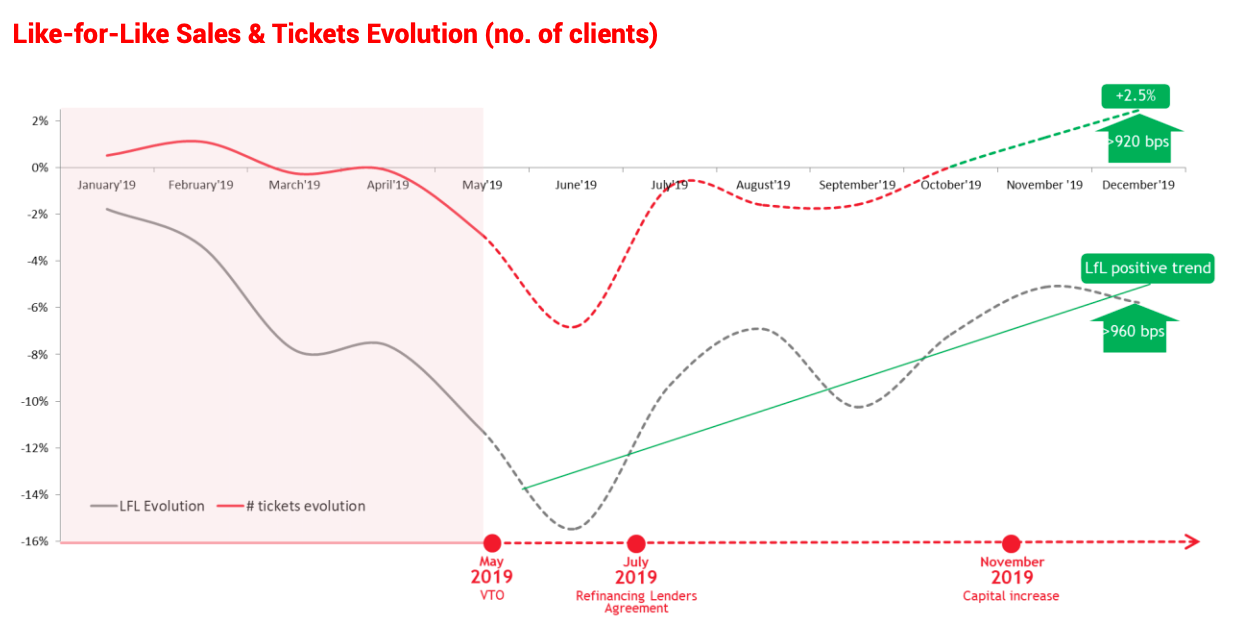

Throughout 2019, the Company has been operating in a highly disrupted and volatile business, financial and corporate context which, despite having a positive final resolution at mid-year, has nevertheless taken a substantial toll and affected the operating performance during the year. DIA’s net sales decreased by 9.3% to EUR 6.87bn down 2.2% in local currency. Like-for-Like sales decreased 7.6% but driven by a -0.7% in the number of tickets and a 7.0% decline in the average basket, showing the strong resilience of our customer base despite the difficult context of the Company. Adjusted EBITDA (ex one-offs) amounted to EUR 34.1m, compared to the EUR 376m in the same period last year.

After all these effects, the net attributable loss amounted to EUR790.5m in 2019, versus a EUR352.6m. loss in the re-expressed 2018 accounts. Net financial debt (excluding impact IRFS16) was EUR1.32bn at the end of 2019, down EUR133,8m. year-on-year. At 31 December, the Company had EUR420m. of available liquidity. The number of stores operated at the end of the year was 6,626.