DIA Group reaches 124 million euros of Adjusted EBITDA in 2021 maintaining 2020 levels.

The maintenance of Adjusted EBITDA, 1.1% higher than in 2020, reflects the positive results of ongoing operational management and cost control despite an environment of increasing energy and raw material prices.

The increase in the price of electricity meant an extra cost of forty million euros for the group, mainly in Spain, which has increased operating expenses.

2021 has been a year of great progress for the company, having worked on the implementation of the main transformation pillars announced in May 2020.

DIA Group wants to show its absolute rejection to the war and convey its consternation, solidarity, and support to the Ukrainian people.

DIA Group has not currently been affected, in any way, by the sanction imposed on Mr. Fridman.

Las Rozas de Madrid (Madrid), February 28, 2022: DIA Group (BME: DIA), a leading network in local supermarkets, published its financial results for the 2021 financial year, at a time of great consternation over the situation in Ukraine, a conflict for which the company has shown its absolute rejection. “We would like to express to the Ukrainian people a [strong] message of solidarity and support in this moment of heart-wrenching suffering which is affecting many thousands of people and fills us with great concern,” explained Stephan DuCharme, executive president of DIA Group, during the presentation.

In relation to the results, 2021 has been a year of great progress for the company. During the previous year, DIA Group worked on the implementation of the main transformation pillars announced in May 2020 and continued to advance in its new business model, giving momentum to the evolution of the company to fulfill its purpose of being CLOSER EVERY DAY

2021 has been a central year in the transformation of DIA with the aim of building a new store concept based on a new commercial definition and value proposition for its customers. Among the execution of the priorities, the redefinition of the store stands out with new models already implemented in Spain, Argentina, and Portugal, where more than 1,000 stores have already been transformed. The ideal assortment has been developed through the renewal of the own brand and fresh products, with the launch of approximately 2,000 references in the last two years, further raising the products quality and value perception. The relationship with franchisees has been consolidated, strengthening a new franchise model based on a genuine partnership with franchisees who are an example of local entrepreneurship, and which has been implemented in almost the entire network of stores in Spain and Portugal. In short, a transformation process to guide all employees towards the construction of a new DIA Group customer centric culture based on close, transparent, and trusting relationships with all stakeholders.

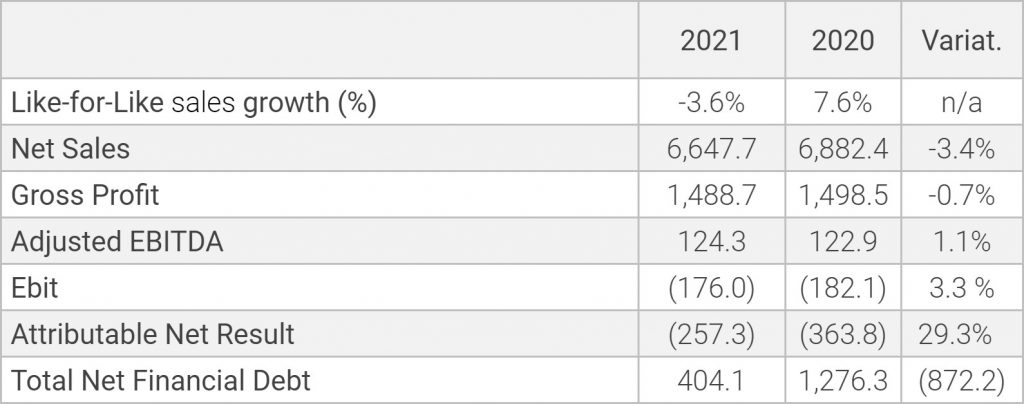

As a result of all this transformational process in which DIA Group is immersed, an Adjusted EBITDA has been reached in 2021 of 124 million euros, which is 1.1% more than in 2020. As anticipated by the company on January 20, Net Sales reached 6,648 million euros, which is 3.4% less than in 2020. This decrease is mainly due to the 3.8% reduction in the number of stores at the end of the period and the devaluation of the Brazilian real and the Argentinian peso. Therefore, the Group has managed to improve adjusted EBITDA in a very demanding environment thanks to operational management and cost control, which have managed to compensate for lower net sales compared to 2020 and the increase in the price of electricity.

Like-for-Like sales have experienced an increase of 5.0% in 2021, compared to 2019. On the other hand, if compared to 2020, Like-for-Like fell by -3.6%. This is due to the extraordinary supply purchases experienced by the Group in 2020, in all markets, due to the lockdowns caused by the onset of the Covid-19 pandemic worldwide and which in 2021 have been normalized.

On the other hand, attributable Net Result, which was negative, improved by 29.3% due to a reduction in financial expenses of 60.2% due to lower financing costs and active management of exchange rate risk. The Group had a Net Result of -257.3 million euros compared to -363.8 million euros in 2020.

It should also be noted that the increase in the price of electricity had a strong impact on the increase in the Group’s operating expenses, rising from 5.7% to 6.5% as a percentage of net sales. The cost of electricity, especially in Spain, meant an extra cost of 39.9 million euros. Similarly, the expenses related to the process of remodeling stores have entailed an additional cost of 16.1 million euros in the Group as a whole.

2021 FINANCIAL HIGHLIGHTS (all figures in € million)

Stephan DuCharme, Executive Chairman of DIA Group, said: “Over two years ago, DIA Group began a new stage marked by an exhaustive transformation of its strategy, its business model, its processes and its offer, but, above all, of its way of doing and understanding relationships as an organization.

During 2021, DIA Group made significant progress in the implementation of our strategic roadmap through a series of initiatives ranging from the commercial and operational areas to the field of franchising and technology in the four geographical areas, and in which we are obtaining very satisfactory results.

2021 has been an important year because customers are having the opportunity, after a long time, to rediscover DIA. The increases in sales that we are seeing in our new concepts of proximity stores, as well as the increase in sales weight of fresh and own brand products, and the improvement in the levels of satisfaction of our customers and franchisees, endorse our advances.

In 2021 we made significant progress on our roadmap, and although we still have a long way to go, we are making steady progress and are confident about reaching our strategic purpose, to make DIA Group the preferred proximity shopping experience and a leading operator in the distribution of food in the geographies in which we operate together with the local entrepreneurs who are our franchisees. To do this, we put the customer at the center of everything we do and work to regain their trust and that of all the stakeholders who continue to support us every day. “

On the conflict in Ukraine

DIA Group is a Spanish company, founded in Madrid and present today in four countries, Spain, Brazil, Argentina, and Portugal, where thirty-six thousand people work every day to create close relationships with the communities where it operates. The current Board of Directors is made up of Spanish, Brazilian and Portuguese members, who try to reflect in a plural way interests from different international markets.

During its more than 40 years of history, the shareholding of Grupo DIA has been composed of investors of various nationalities and origins. Currently, its majority shareholder, LetterOne, is an Anglo-Luxembourg international company.

Regarding the sanction imposed on Mr. Fridman, “we want to convey a message of stability and express that DIA Group has not been currently affected in any way,” says Stephan DuCharme. No shareholder of LetterOne, including Mr. Fridman, holds, either individually or by agreement with other shareholders, control of LetterOne. Therefore, neither LetterOne, nor consequently DIA, are subject to any sanction.

“From the DIA Group, we are working intensively and with agility in different ways of contributing value to the Ukrainian people of which we will inform you soon,” he added. “Likewise, we want to convey a message of hope to the recovery of dialogue and understanding by appealing to peace and solidarity of all those affected with whom we also want to be close. “