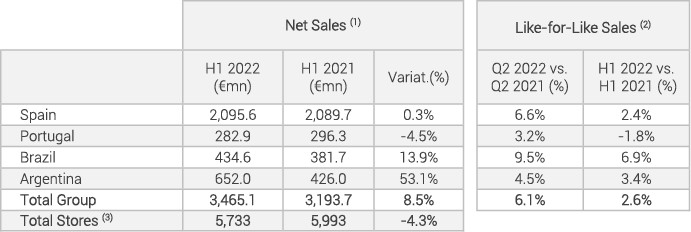

Group net sales up 8.5% to €3.46 billion

Sales in the first half of 2022 showed a key turning point for Grupo DIA. The transformation is now paying off, allowing us to assert that the Group has entered the consolidation phase following the transformation process that began three years ago, with a new customer value proposition in our stores, a new store model widely implemented throughout the network, a revamped franchise model that continues to punch up in its activity, a standout offering with a wide assortment including quality fresh produce, and a renewed, modern and distinctive private label.

Q2 showed positive comparable Like-for-Like sales across all markets, particularly a strong recovery from Q1 in Spain and Portugal (up 6.6% and 3.2%, respectively) and excellent progress in Brazil and Argentina (up 9.5% and 4.5%, respectively).

Net sales from franchised stores continued to grow, reaching 35.6% of total sales in all Group stores in H1 (32.2% in the same period 2021). This progress indicates how well the model has been embraced by our franchise partners and the excellent work they are doing, in addition to the good reception from our customer base.

Spain delivered 0.3% net sales growth, despite a 3.9% reduction in store network compared with the first half of 2021. Portugal recorded a 4.5% decrease in its net sales and a 1.0% reduction in store network.

Net sales in Argentina continued to perform exceptionally well, driven by above-currency-devaluation inflation, which has risen to 13.6%, and a 3.7% uplift in the number of stores. Brazil, meanwhile, logged net sales growth of 13.9% despite an 18.2% reduction in the number of stores, having benefited from the 17.5% revaluation of the Brazilian real over this period in 2021.

1H 2022 Trading Update

At the close of June the company had 1,775 stores operating under the new store model, i.e., 46% of our local network(4) at Group level. By country, 1,297 stores were operating under the new model in Spain, 366 in Argentina, and 112 in Portugal. Sustainable sales growth was seen in all three countries, while the own-brand rollout continues, with the Group having released more than 2,700 new references since 2019.

The complex economic situation, marked by inflation and rising fuel, energy and raw material prices, is already changing customer behavior, with people visiting stores more often, but spending less. This can be seen by the 5.7% rise in number of tickets in the first half of the year, as a proof of the trust our customers have in us, but a 2.9% fall in average basket spend. This behavior is typical in uncertain times like the one we are going through. From January to June, DIA private label weight on sales rose to 51.7% in Spain, compared to 47.7% in the same period last year, highlighting the good rollout of DIA´s New Quality and its perception as a modern, high-quality and well-priced brand.

Commentary on the first half of the year 2022 by Stephan DuCharme, Executive Chairman:

“We are experiencing a change of phase headed towards consolidation of the business. The positive sales performance during the second quarter allows us to envision the consolidation of a change that began in 2019 with a thorough review of our operating model that led us to focus our strategy and value proposition on our most powerful lever: proximity. Since May 2020, we have systematically implemented our roadmap with wide-ranging commercial, operational, franchise and digital and technological transformation initiatives across the four countries where we operate”, said Grupo DIA chief executive Stephan DuCharme.

“We did it off the back of a responsible, ethical, performance-oriented corporate culture and sense of commitment driven by our world-class leadership and daily endeavor to strengthen relationships with the customers, suppliers, franchisees and employees without whom this company would not be what it is today.”

“There are still challenges in front of us that not only affect DIA but the whole industry and are a matter we have to address. DIA Group believes the challenges presented by our current environment are an opportunity to make our proposition of proximity and ambition of leading the neighborhood store more relevant than ever. We want to get closer to our customers every day and help them through these uncertain times. That is why we strive to ensure that our value proposition meets our customers’ local needs through an easy, accessible shopping experience with a wide assortment and commitment to fresh food, a high-quality private label and the best value for money”.

1. Net sales expressed at current exchange rates and applying IAS 29 “Financial Information in Hyperinflationary Economies” in Argentina.

2. Represents the growth rate of Gross Sales Under Banner at constant exchange rate of those stores that have operated for a period of more than twelve months and one day under similar business conditions. Gross Sales Under Banner represent the total value of the turnover to the end customer obtained in the stores, including all indirect taxes and in all group’s stores, both owned and franchised (see Definition of Alternative Performance Measures in the Management Report). Sales figure Like-for-Like in Argentina has been adjusted using internal inflation to reflect the variation in volume (units), avoiding erroneous calculations due to the effect of hyper-inflation.

3. At the end of the period.

4. Excluding Maxi stores (Spain and Portugal), La Plaza and Clarel.