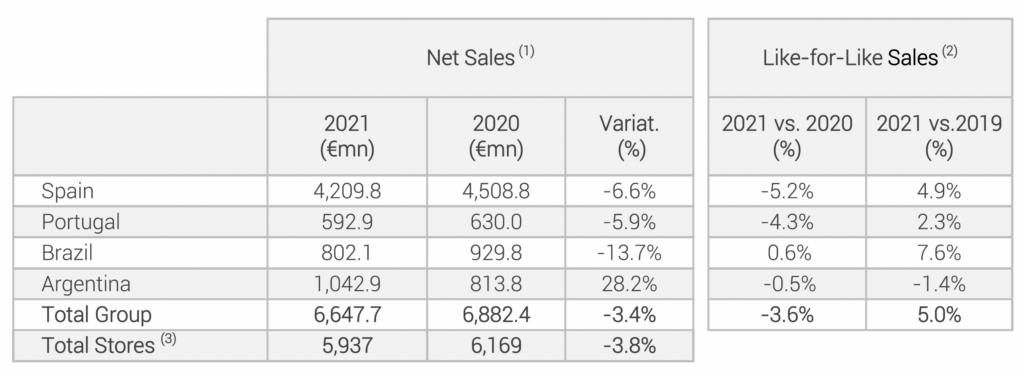

The group’s net sales reached €6.6 billion with a 5% increase in Like-for-Like sales compared to year 2019, pre-pandemic levels

2020 was marked by extraordinary purchases of supplies due to mobility restrictions related to Covid- 19, mainly in Spain and Portugal, which have been normalised in 2021 reducing comparable Like-for-Like sales by 3.6%.

The number of tickets, and therefore the frequency in store, grew by 3.3% in 2021, while the average basket size fell by 6.7% showing a change of trend compared to 2020. This was due to the relaxation of restrictions, which facilitated an increase in the purchase frequency of customers with smaller baskets.

Brazil and Argentina showed a resilient performance in challenging macroeconomic environments, with Like-for-Like sales similar to those of 2020.

Net sales in Argentina showed an exceptional performance driven by the success of the operational and commercial measures deployed, and higher inflation than the currency devaluation. Brazil was affected by a 4.2% reduction in sales area and an 8.8% devaluation of the Brazilian Real.

2021 Sales Advance

Commentary on the year 2021 by Stephan Ducharme, Executive Chairman:

“2021 has been a challenging year in terms of the year-on-year evolution of sales. Although our comparable sales have improved by 5% compared to pre-pandemic sales levels of 2019, we are conf;dent that 2022 w1!/ prov1de a clearer perspective on sales momentum derived from the various transformation measures put in place. In 2027, over one thousand stores have been remodelled in Spain, Argentina and Portugal, which are reporting a sigmficant improvement in sales growth. The new franchise model in Spain, Portugal, Argentina and Braz1!, and the great progress made in al/ our geographies in the development of an optimised assortment focused on the enhancement of fresh products and a higher quality own brand, are having an excellent reception among our customers and franchisees.

The inflationary context that we have experienced in 2027 – marked by the rise in electriclty, fue/ and raw materials prices – and which is expected to extend for much of 2022, is generating inflationary tensions in the sector

Thanks to the effort and commltment of our employees, DIA continues to work s1de by s1de wlth our franchisees and supp/iers to offer a competitive value proposition and be CLOSER to our customers EVERV DAV in a complex economic and social context”.

Net Sales expressed at current exchange rates and applying IAS 29 “Financia! lnformation in Hyperinflationary Economies” in Argentina.

Represents the growth rate of Gross Sales Under Banner at constant exchange rate of those stores that have operated for a period of more than twelve months and one day under similar business conditions. The Gross Sales Under Banner represent the total value of the turnover to the end customer obtained in the stores, including all indirect taxes and in all the stores of the group, both owned and franchised (see Definition of Alternative Performance Measures in the Management Report). Sales figures Like-for-Like in Argentina have been adjusted using interna! inflation to reflect the variation in volume (units), avoiding erroneous calculations dueto the effect of hyper-inflation.

At the end of the period.