DIA completes its global capitalization and refinancing process.

Thanks to the successful capital increase and debt refinancing in August and September, respectively, net debt is reduced in €1,028 million establishing a sustainable long-term capital structure.

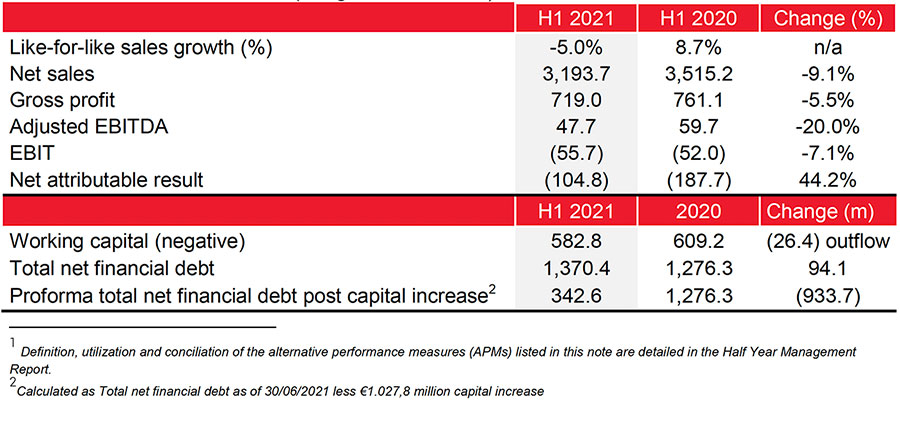

Adjusted EBITDA margin stands at 1.5% and losses are cut by a 44% in the six-month period thanks to operational improvements and cost containment.

Year-on-year comparison of sales affected by Covid-19 stockpiling in the second quarter of 2020.

2021 priorities continue to focus on revamping the commercial offering, rolling-out the updated franchise model, store refurbishments, expanding online service and operational improvements.

CLOSING OF COMPREHENSIVE CAPITALIZATION AND REFINANCING TRANSACTION

On 4 August 2021, the Company announced a complete subscription of the €1,028 million capital increase that received a demand of 1.67 times the number of shares offered in the cash tranche of €259 million. The remaining €769 million consisted in the capitalisation into capital of all credits held by the reference shareholder Letterone. The new shares were admitted to trading on 13 August 2021 and resulted in a free float of 22.3%.

On 2 September 2021, all of the conditions precedent necessary for the effectiveness and closing of the comprehensive capitalization and refinancing announced by the Company on March were successfully met, which translates into a reduction in net financial indebtedness of c.75% and the extension of debt maturities up to years 2025 and 2026.

This transaction represents the main financial milestone achieved by the Company in the last two years, sets a solid long term capital structure and provides the Company with additional liquidity to continue with its deep transformation process.

H1 2021 – KEY FINANCIALS1

(all figures in € million)

Stephan DuCharme, Executive Chairman comments:

“The completion of DIA Group’s global agreement on capital structure and re-financing represents a strategic milestone for the Group and the culmination of an intense process to further improve the group’s capital structure in support of an acceleration of the Group’s business transformation and growth program.

I would personally like to take this opportunity to thank all our shareholders and creditors for their support in this successful operation. We look forward to continuing to work hand-in-hand with all of the Group’s financial partners towards our strategic objective of making DIA Group the preferred proximity shopping experience and a leading food retail operator in the geographies in which we operate.

Based on the foundation of world class leadership, long-term relationships with all stakeholders based on trust and a performance-based culture, DIA Group is systematically implementing its strategic roadmap of May 2020 through a wide-ranging series of commercial, operational, franchise and technology initiatives across our 4 geographies. The strategic roadmap is aimed at placing the customer at the heart of everything we do and delivering sustainable long-term results for all stakeholders.”